Simulation module

The Simulation module is one of the main features of the Alpha-Trading python library. It allows both to build, test trading strategies and build and test more complex models that can be used to improve strategies, analyse financial data, stress-test strategies and build risk-management systems around signal generators.

1. Backtester module

1.1 Presentation of the tool

I initialy developed the backtest tool in order to test my own trading strategies in an environment 100% controllable, fully customizable and designed to garantee absence of look-ahead bias during strategies backtest. It has been structured in a such way that simulations are as much as possible close to the reality of a live-trading environment. The trading process on financial market can be extremely complex and cover a wide range of possible actions. Because it is impossible at a human-scale to think about every way to trade on financial markets, I tried to develop a solution that reponds to the standard way of trading on financial markets.

That is why for instance, the backtester is designed to simulate trading strategies dedicated to Forex, Stocks and CFDs markets. Simulated trading orders have a bracket shape.

# Structure of the function allowing to place trading orders

placeOrder(

symbolName,

action = "long", # "long" or "short"

orderType = "MKT", # Order kind : "MKT", "MIT", "LMT"

volume = 0.1, # Volume

stoploss = None,

takeprofit = None,

lmtPrice = None,

auxPrice = None) :

This structure is actually sufficient for most of trading strategies. However, the backtester includes some features that make it unique!

1.2 Features

Historical data correction

The backtest tool includes a tool allowing to correct and prepare financial data for a high-precision and performance backtest. This tool embeds the following functions:

-

A missing data filling model: Very often financial data presents gaps at different times and for different reasons. It can be because of a lack of recording quality from the provider or simply because markets are closed during the weekends. In the backtest module of the Alpha-Trading library, we fill every gap existing in the data (at the resolution time-scale) according a data-filling model. For instance missing data is replaced by constant data but the user can create his/her own missing data filling model. Soon I will propose a missing data filling model based on GANs.

-

Time alignement of data: Depending on the location of the data provider, the time zone associated to data is not corresponding to your neither the one of the exchange corresponding to the retrieved data. In the backtest module of the Alpha-Trading library, we shift the historical data in the time zone corresponding to the one where the exchange is located. This way we ensure (for most of data) that if the market close during the night, it will close the night of the day \(N\) and re-open the morning of the day \(N+1\). This facilitates the process of data re-sampling (see two points below).

-

Exchange state data: Because the Alpha-Trading backtest tool tends to fill all the time gaps in the data. One need to provide to the user the information about the state of the market at each timestep. This functionality allows for example to a user to specify dates at which the exchange was closed for a non-cyclic reason, so it prevents the algorithm to operate over periods which have never been existing and consequently increase the precision of the backtests.

-

Data resampling tool: Often, trading strategies involves indicators based on a data with a large time-scale resolution such as H1 for example. But to have a great backtest precision and illustrate all possible situations in real life, one needs to backtest using small time-scale resolution data such as M1 for example. There are usually two solutions to overcome this problem: the first one consists in downloading M1 data and H1 data from the same asset but this can lead to data inconsistencies for a lot of reasons, the second solution consists in building H1 data from the M1 data, and a lot of resampling tools exists to do so (such as pandas.resample for example), but all these tools doesn’t take in account the structure of an exchange day range and re-sample data in a random way. In the Alpha-Trading backtest tool, the data resampling tool takes in account the structure of a trading day and resample data accordingly so that after resampling M1 data into H1, user will automatically have access to H1 data candles EXACTLY similar to what he/her would obtain by retrieving H1 data from the broker.

-

Data synchronisation tool: Resample data before a backtest in usually a dangerous operation because it open the doors to a possible look-ahead bias. In the Alpha-Trading backtest tool, we propose a (multi-scale and multi-asset) synchronization tool which takes care that user cannot have access to future data from resampled data. For example the 9:00 H1 candle data will be available to the user only at the same time step where the 10:01 M1 candle data will be available. The synchronization tool also allows to synchronize data from different assets. Lets say you want to create a statistical arbitrage strategy using GOOG and APPL data but your GOOG data goes from 2010-01-10 12:30 to 2020-10-15 22:35 and your APPL data goes from 2009-09-17 04:25 to 2019-02-03 15:42. After filled every gaps and resampled both data according your needs, the algorithm will cut the edges of your data and index-align them together in a such way that your final dataset time start will be 2010-01-10 12:30 and your final dataset time end will be 2019-02-03 15:42. Moreover for a given index, the corresponding time for APPL and GOOG will be the exact same, this no matter what is the current exchange state of each instrument.

Contract properties simulation

Often differences between backtest and live trading can comes from the absence of considerations of constraints defined by the contract selected for trading. To overcome this potential simulation bias, the Alpha-Trading backtest tool includes a tool to simulate contract properties as described below:

-

Contract size: Depending on the Broker and the instrument, a lot can have different size an hence necessite a minimal amount of liquidity to be traded.

-

Currency: (Not implemented yet!). One can define instruments based on a currency and trade them on another currency thanks to a supplementary dataset allowing to convert your currency in the instrument’s one.

-

Contract type: CFD, Forex, Stock, CFD-Index. Depending on the contract type, the margin is calculated differently. These models allow to calculate the real returns you would get depending on the instrument type. This property is important in the case where you backtest a trading strategy working on two different kind of contracts for example.

-

Required margin percentage: To ensure your solvability to any market event, brokers often define a minimal margin percentage required to trade an instrument. In a backtest performed without a such constraint one can fall in the trap where simulated orders have been placed and won’t have been in the reality of trading. In the Alpha-Trading tool we take in account a such constraint and we let the user define his/her own required margin percentage. This value is specific to each involved contract.

-

Execution mode: (Not implemented yet!). Depending on the state of the market or for some instruments, the trades execution mode can be different. The common execution mode is time to market, but one can be different and be close only for example.

-

Volume constraints: For obvious reasons, every Broker imposes volume constraints. These are in terms of volume size : minimal volue \(\rightarrow\) maximal volue, or in terms of volume discretization : number of digits. To not consider such constraints can lead to consider trading order that would have been refused in the reality. In the Alpha-Trading backtest tool we take in account this constraint.

-

Fees: (Not implemented yet!). Depending on the broker and the trading status, some fees can apply. These fees can have a non-negligible impact on the strategy’s return.

Portfolio constraints simulation

The Alpha-Trading tool allows to simulate one or more portfolios and simulate constraints on them. While each backtester propose to ajust standard portfolio parameters such as: initial income, leverage, currency (not implemented yet), we worked to the implementation of constraints on the portfolio defined at the begining of the simulation and such that if the portfolio meets one of them, trading is not allowed anymore. This is an important point which can happen in the reality but which is often not considered in backtest mode. The available constraints are:

-

Position type: The market can be constrained to only long positions for example, or long and short, or rarely (probably never) only short. This means that if your trading strategy wants to place a non-allowed order, it will be refused by the simulator.

-

Margin call treeshold percentage: If your available margin becomes lower than the margin call treeshold, your strategy won’t be able to open any position as long as you do not increase your margin.

-

Margin Minimum percentage: If your available margin becomes lower than the minimum margin treeshold, the simulation will start to close the position in which you are the most losing, check again your margin, and either close another losing position if your margin is still below the treeshold, either nothing.

-

Minimum balance: Below the minimum balance, trading is not allowed anymore.

-

Maximum profit: Above a certain amount of positive profit, trading is not allowed anymore. This constraint has to be used as a signal that something may be wrong in the way that the trading strategy is backtested and the profit made is abnormally high.

-

Maximum dradown: Above a certain drawdown, your trading strategy may be dangerous. Trading won’t be allowed anymore. Correct it.

-

Maximum consecutive loss(gain): Above a certain summed value of consecutive losses(gains), trading is not allowed anymore. These constraints have to be used as detectors of a wrong backtest way of the trading strategy on any other strange (not realistic) behaviour.

-

Maximum number of consecutive gain: Same constrain as above but the metric is the NUMBER of gains and not the total summed gains value.

Multi-Instruments backtest

The Alpha-Trading backtest module, thanks to its features of filling missing data and data synchronization, is able to involve more than one instrument in a unique backtest. This feature opens the doors to backtests of statistical arbitrage like strategies and any trading strategy dedicated in trading simultaneously on multiple instruments. Event if it is possible to backtest a multiple-instrument strategy on each instrument separately and re-construct the results after both backtest, here, we allow to do it in a totally mastered environment where each small bias or default of the strategy will be detected.

Multi-Portfolio backtest

The Alpha-Trading backtest module is structured in a such way that for a given strategy it allows to simultaneously backtest it on multiple portfolios and with multiple strategy parameter sets. To do so the program create couples (portfolio instance, strategy instance) and each couple can be backtested with three different methods: sequencialy, sequencialy (step-by-step), or in parallel (calculations distributed over computer cores).

100% Customizable logging system

The Alpha-Trading backtest module embeds a 100% customizable logging system which records every action made by the simulator or every action made by the trading strategy specified by the user. This way one can register absolutely any detail in the simulation and use it either to find bugs in the strategy, in the simulator, or to improve the strategy through learning on meta-labeling for example. The logging system write create SQLite databases where a default log table is created by the simulator and any other table can be created by the user.

Sub-candle simulation modding

In order to improve the quality of the simulation, and to explore all the space of possibilities, the simulation can run the price data according different modes:

- close only: This mode only take in account the close values of each candle

- ohlc: This mode scrolls each candle price in the following order: Open, High, Low and then Close

- ohlc random: (Not implemented yet!) This mode corresponds to the above mode but High and Low order is randomized.

- ohlc GAN: (Not implemented yet!) After observing data behaviour at tick scale, this mode allows to generate data at sub candle space in order to simulate very small price fluctuations.

Data perturbation models (soon…)

1.3 Structure and components

The Alpha-Trading backtest module has been designed to separate as much as possible modules concerning the backtest itself from modules dedicated to trading strategies development. That is why backtest a trading strategy with this tool requires at least two python files:

- The trading strategy file

- A simulation header file.

1.3.1 The Simulation header file

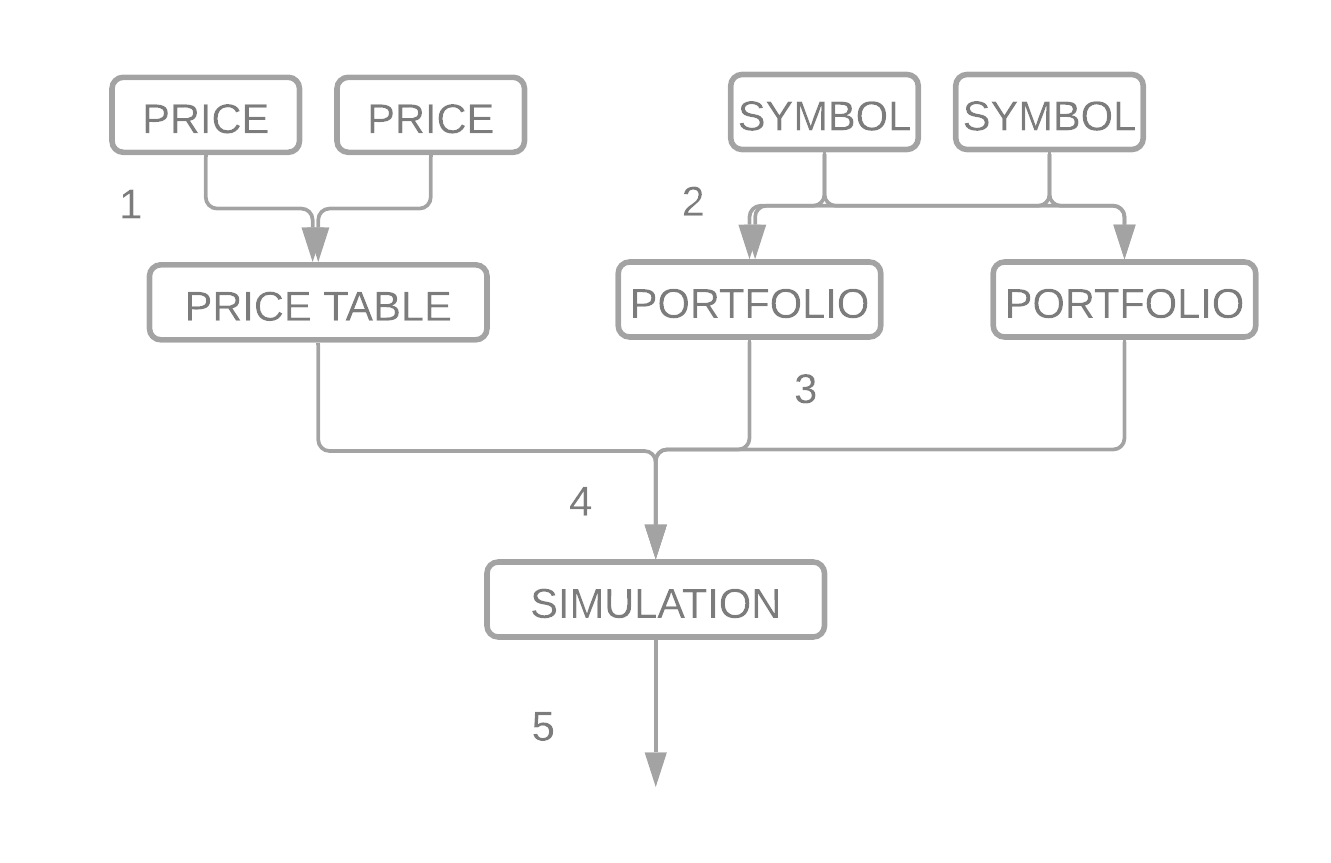

Both file has its own dedicated structure. Here we are going to see how the simulation header file is designed and the details relative to each design step. The structure of the simulation header file is presented on the figure here below where each nametag corresponds to a pythonic object, arrows refer to the insertion of an instance inside another pythonic object and numbers refer to the different coding steps of the so-called simulation header file.

Let describe the different involved objects with their main properties:

- PRICE: The PRICE object allows to read, interpret and prepare a dataset for the simulation.

- PRICE_TABLE: The PRICE_TABLE object allows to concatenate each unique PRICE object within a list and synchronize them for the simulation.

- SYMBOL: The SYMBOL object corresponds to the identity card of a PRICE object within the simulation. While the PRICE object contains the financial dataset, the SYMBOL contains informations related to brokerage. PRICE and SYMBOL are linked together by providing the same name attribute.

- PORTFOLIO: The PORTFOLIO object allows to simulate your portfolio and some regularoty constraints.

- SIMULATION: The SIMULATION object allows to parametrize the properties related to the while loop itself and perform the backtest.

1.3.2 The Trading strategy file

All the trading strategy must be embeded in a class called STRATEGY. This class contains three important methods

which will be called by the SIMULATION class in the backtest module:

self.__init__(): This method allows to define the trading strategy initialization parameters and important buffers.self.run(client): This method allows to execute the strategy by operating on theclientparameter which correspond to aPORTFOLIOclass object.self.show(client): This method is not executed at each timestep but at a frequency specified by the user. It shouldn’t be used to run trading operations but only logging and simulation informative actions.

class STRATEGY :

"""

The STYRATEGY class is imported in the SIMULATION class.

Only 3 functions are important and executed in the backtester :

- __init__ : To declare the strategy object

- run : Function called to each timestep of the simulation

- show : Function called to each log step of the simulation

One can add any function in this class. This will not pertubate the

simulation.

run and show functions take in account a "client" parameter which

corresponds to the "PORTFOLIO" object as declared in the simulation

header file.

"""

def __init__(self) :

return

def run(self, client) :

return

def show(self, client) :

return

1.5 Relevant links

To get more informations about the Alpha-Trading backtest module I suggest trying by yourself this hands-on module.

Models

(Soon…)